With a wide variety of possible ingredients, all of them are presented as concentrated sources: micronutrients vitamins and minerals, amino acids, fatty acids (oleic acid, Omega 3,…), coenzymes (Q10), flavonoids/carotenoids (lutein, astaxanthin,…), polysaccharides and oligosaccharides (beta-glucans, guar gum, etc…), prebiotics, probiotics, a wide variety of plants (botanical species), among others.

Increasingly present in diets, the food supplements market has accumulated a total growth of 20% from 2020 to mid-2023. In Spain alone, the sector’s turnover rose from €1.7 billion in 2019 to more than €2 billion in 2023 (source: FIAB).

Food supplements: An increasingly competitive market

In many European countries, supplements must be notified to the health authorities of the country where they are intended to be marketed. Depending on the country, the lists of notified food supplements are made public. In December 2024, between Spain, France, Italy and Belgium alone, 168,861 food supplements were notified in each country’s national database:

- Italy: 3502 food supplements

- Belgium: 21089 food supplements

- Spain: 47953 food supplements

- France: 96317 food supplements

These reported food supplements can be mainly classified as follows:

- Vitamins and minerals (multivitamins, iron supplements, calcium, etc.).

- Plants, plant extracts and others (plant extracts, essential oils, etc.).

- Supplements for athletes (proteins, amino acids, fat burners, etc.).

- Probiotics and prebiotics.

- Supplements for specific conditions (e.g. respiratory health, joints, etc.).

“Vitamins and minerals” and “Plants and plant extracts” are the categories with the most notified products; vitamins and minerals with 2065 products notified in Spain and 9757 products notified in France and herbal supplements and plant extracts with 1457 products notified in Spain and around 60,000 products notified in France (source: AESAN, 2024 and DGCCR, 2024).

Consumer preferences:

Following a study conducted by the Mérieux NutriSciences Silliker Panel in 2022, among people who have ever consumed a food supplement, 92% of respondents felt that their consumption had brought them some benefit or that they had noticed some improvement in their state of health.

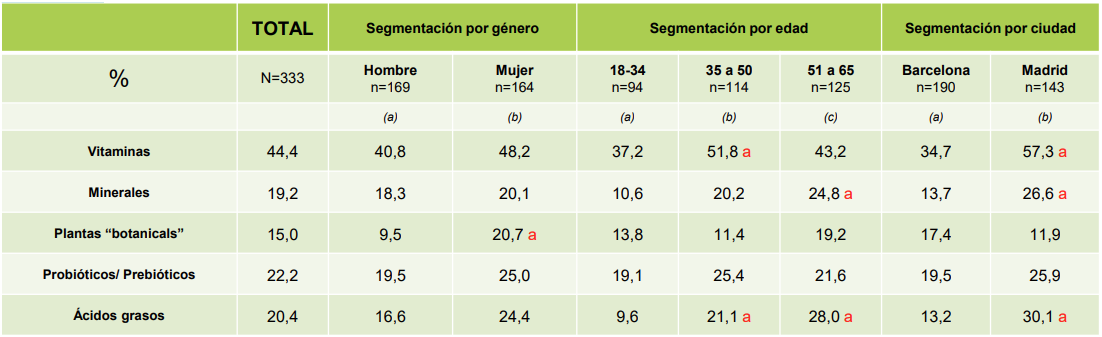

Higher significant differences between segments marked with letters (confidence level, 95%)

With more and more types and formats of consumption, from dragees and lozenges to gummy, drinkable and chewing gum options, companies are faced with a new challenge: that consumers like the consumption format.

Thus, any sensory aspect that can be decisive for the success and viability of the food supplement can be studied in a sensory test with consumers.

Flavor/Aroma: Which one is more appealing, which one masks a chemical taste of some compound, which one is less cloying?

Texture: which one dissolves better, which one is easier to swallow, which one is easier to swallow?

Packaging: which one opens better, which one is easier to carry, which one allows me to drink the product better, which one allows better dosage?

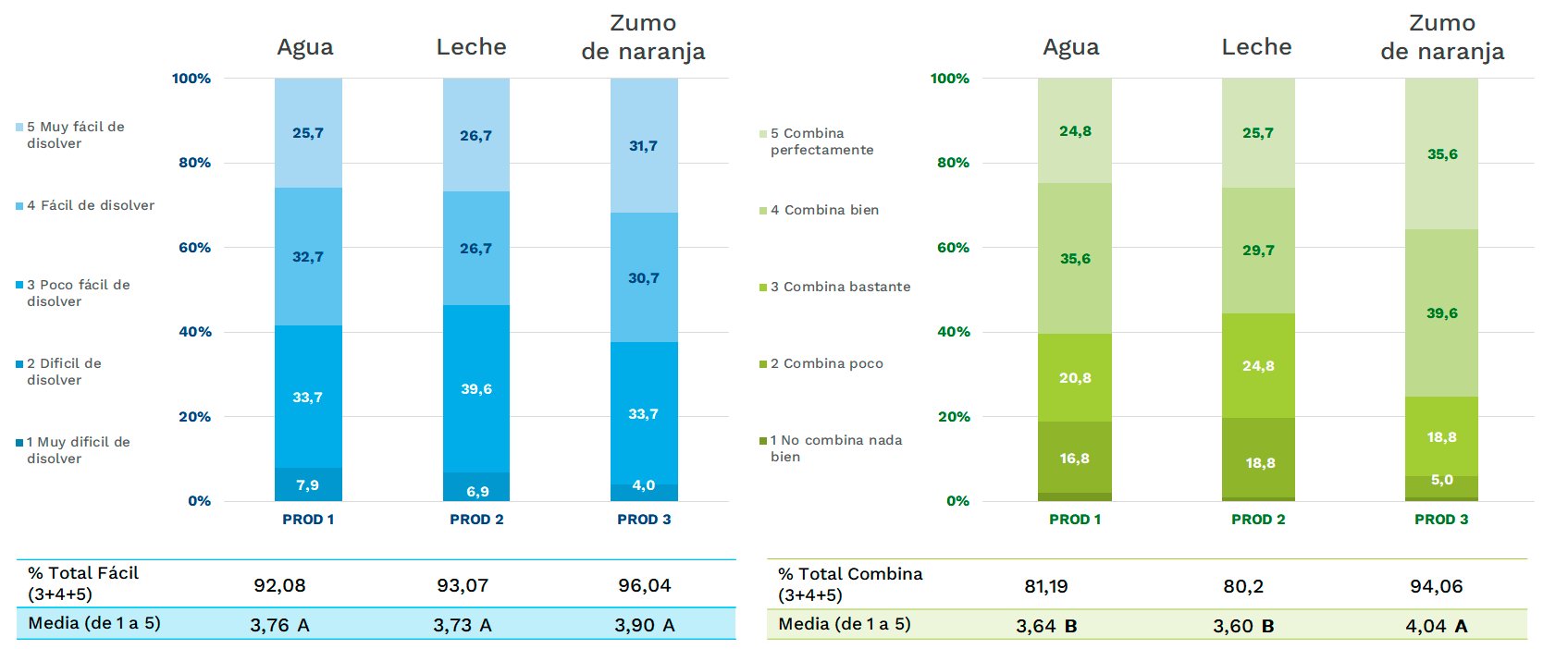

Figure 1: Acceptance test

.

Figure 2: U&A TEST (use and habits)

Does your product consider these aspects compared to the competition, do you consider your target market when formulating your product?

In this sense, when putting a new food supplement on the market, or re-launching your brand/product, consider the following:

- Do I know my population segment?

a. I don’t know it, general population and I analyze by segments to study if there is greater acceptance in a specific profile.

b. I define my target (because I know it). - Consumer profile: what do I take into account?

a. Frequency of consumption or use of the product (CA) (essential criterion).

b. Uses and consumption habits of the CA

c. Usual brands, stores or places of purchase of the product.

d. Age. Gender, socio-professional category, place of residence,….

e. Marital status, number of children, … - current and/or potential consumer?

a. Development: there are no current consumers. Recommended but not essential

b. Maintenance: current consumers.

c. Product improvement: current and potential consumers. Verify if the proposed changes are accepted by the current ones and check if we will attract new ones.

e. Optimization: current consumers.

Mérieux NutriSciences is at your disposal to explain in more depth our services and experience in this type of sensory studies. In addition, we offer you the possibility of evaluating both the composition and the labeling of the food supplements that your company markets or wants to market, both in Spain and in other Member States, as we even accompany you in the process of importation and/or notification in other countries, if necessary.